(615) 424-7773

Need help? Call me!

(615) 424-7773

Need help? Call me!

Most people don’t pay a Part A premium because they paid Medicare taxes while working. If you don’t get premium-free Part A, you pay up to $505 each month. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty.

In 2024, you pay:

In 2024, you pay:

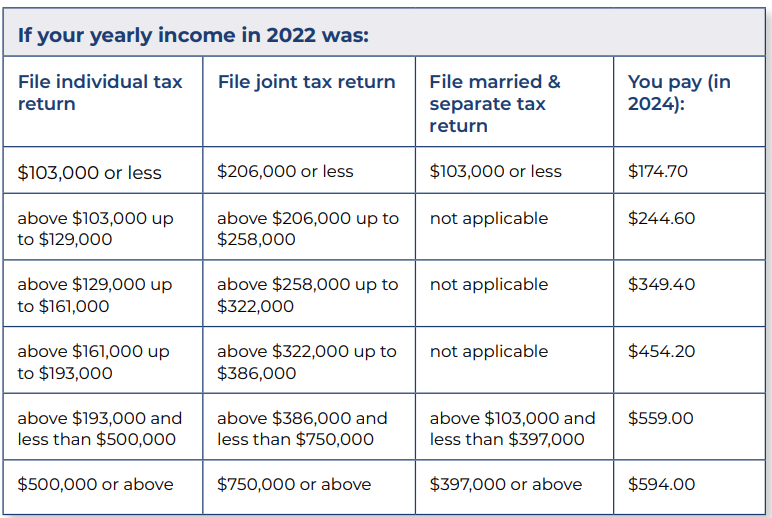

Most people pay the standard Part B monthly premium amount ($174.70 in 2024).

Social Security will tell you the exact amount you’ll pay for Part B in 2024.

You pay the standard premium amount if you:

If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you’ll pay the standard Part B premium and an income-related monthly adjustment amount.

If you have questions about your Part B premium, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. If you pay a late enrollment penalty, these amounts may be higher.

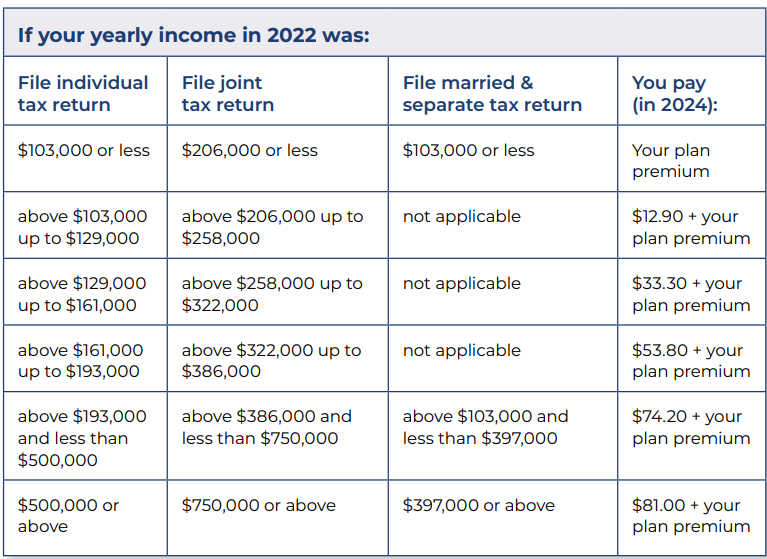

Visit Medicare.gov/plan-compare to find and compare plan premiums. You can also call 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

The chart below shows your estimated drug plan monthly premium based on your income. If your income is above a certain limit, you’ll pay an income-related monthly adjustment amount in addition to your plan premium.

Medicare uses the national base beneficiary premium to estimate the Part D late enrollment penalty and the income-related monthly adjustment amounts listed in the table above. This amount can change each year. If you pay a late enrollment penalty, these amounts may be higher.